20+ Risk Reward Ratio Calculator

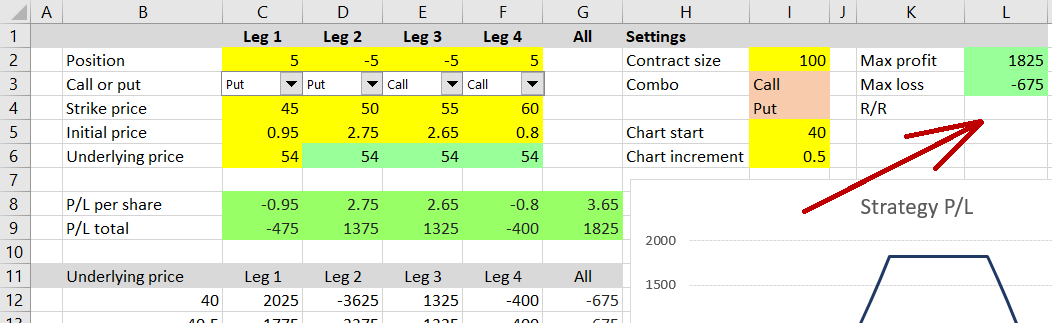

Reward by dividing your net profit the reward by the price of your maximum risk. Portfolio size Margin size Risk Stop loss Portfolio at risk.

Macroption

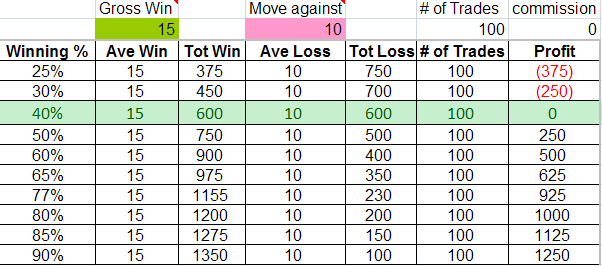

Web Arguably one of the most unique calculators on this site the risk and reward calculator helps you identify winning combinations of win rate and rewardrisk ratio.

. Subtracting the entry point from the take-profit level reveals a potential. Web Risk-reward calculator is a tool used to calculate the ideal risk-to-reward ratio for a given trade. With a few simple inputs our position size calculator will help you find the.

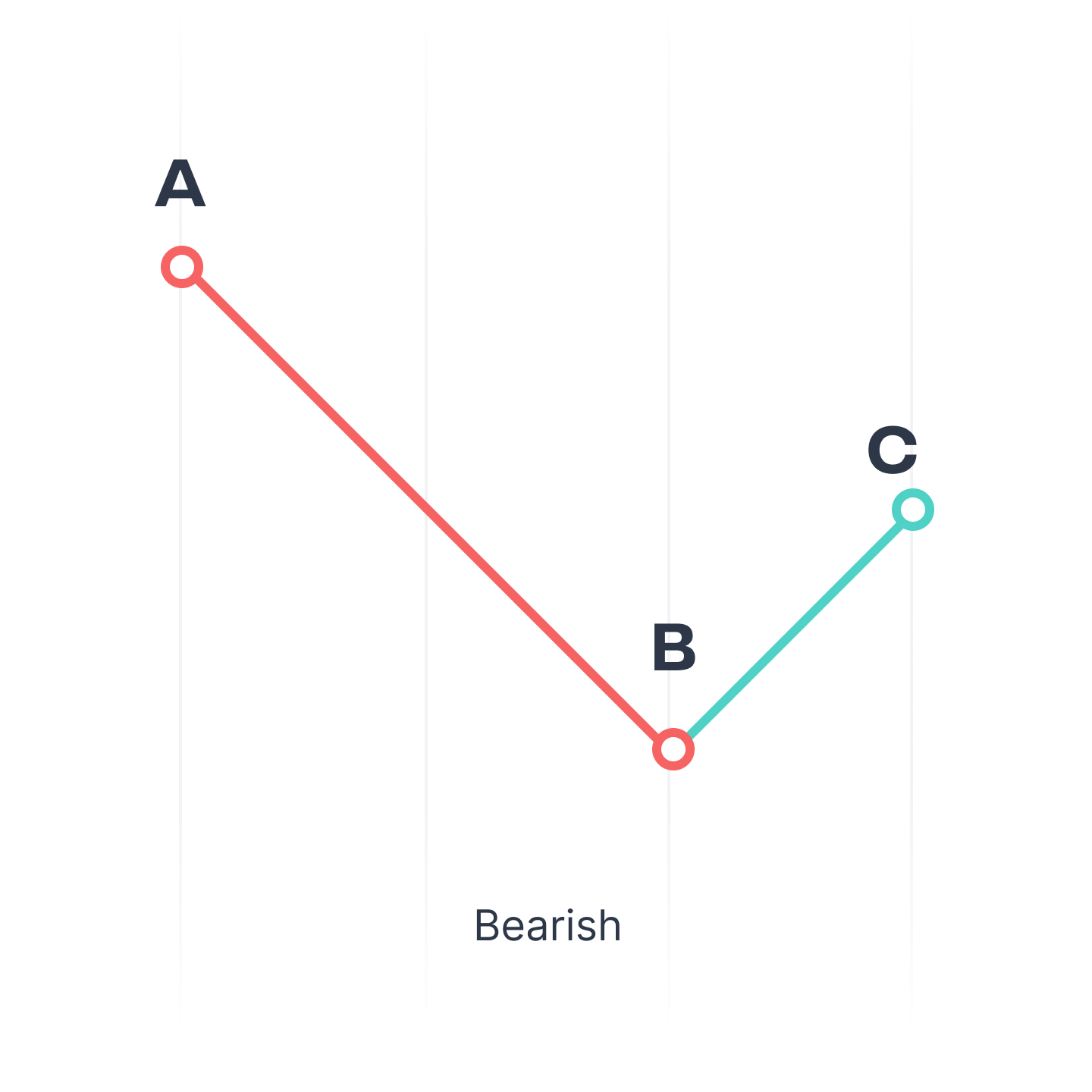

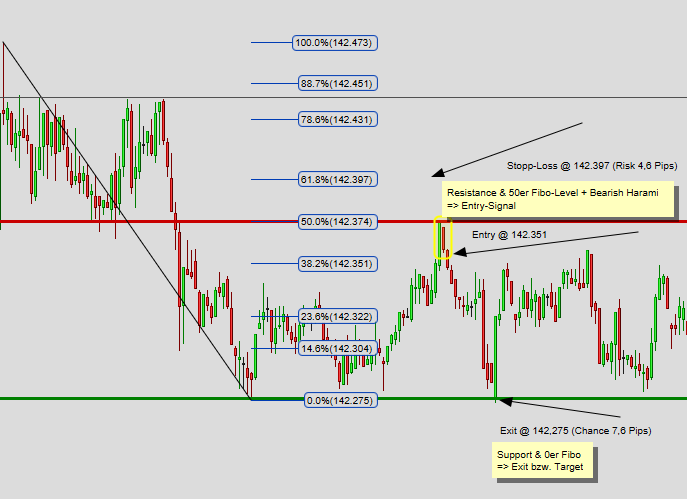

Both of these levels are set by the trader. Web Lets calculate the risk-reward ratio for this trade. It provides a quantitative analysis of the risk.

For example if a trader opens a long position on a stock. Web To calculate the riskreward ratio start by figuring out both the risk and the reward. Web Our Risk Reward Calculator helps you assess your investment or trading strategy by calculating your risk and reward ratios stop percentage profit percentage and.

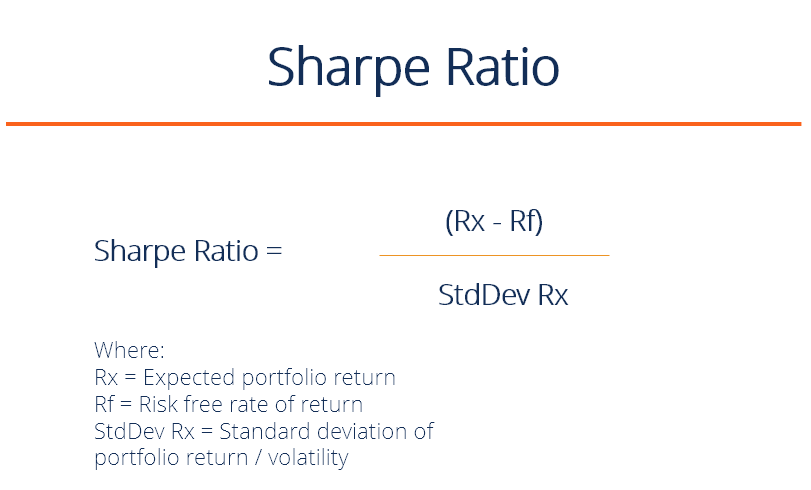

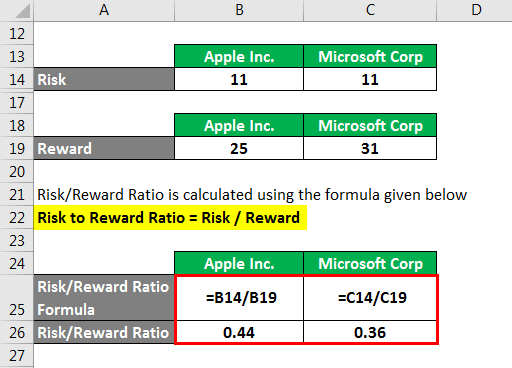

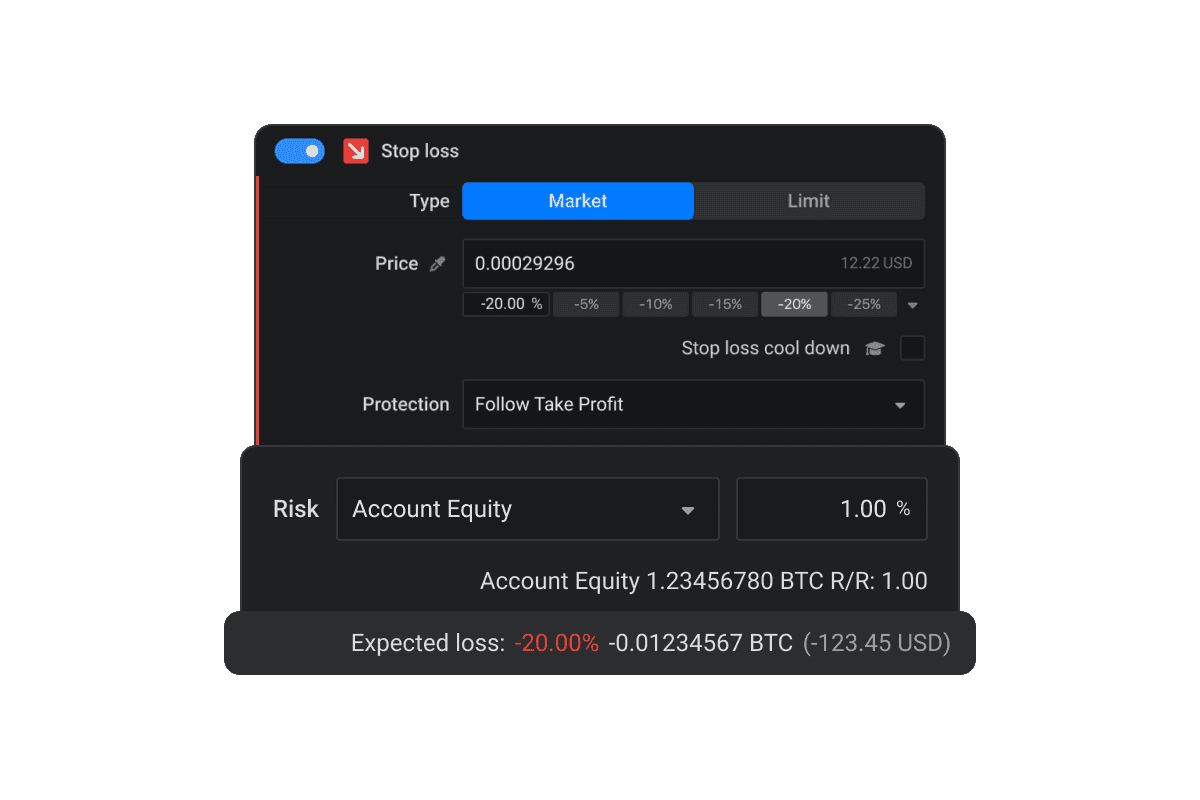

Web Proper position sizing is key to managing risk and to avoid blowing out your account on a single trade. Web It is calculated through the following formula. Risk 20 - 1820 100 10.

Web Calculate risk vs. Web A Risk Reward Calculator is a tool that helps investors and traders assess the potential risk and reward in a trade or investment. Web Firstly set a balance.

Web By subtracting the entry point from the stop-loss level we find that the risk is 100 95 5. RiskReward Ratio Take Profit - Entry Price Entry Price - Stop Loss Price The breakeven win. Risk-Reward Ratio 1025 125.

To incorporate risk-reward calculations into your research. For example if you enter a trade with a. How do you calculate risk reward.

Web Amazing App for calculating Risk Reward Ratio. Web The riskreward ratio is calculated by dividing the amount an investor could lose if the price of the asset unexpectedly moves by the amount of profit expected to be. Thus the riskreward ratio is 4000.

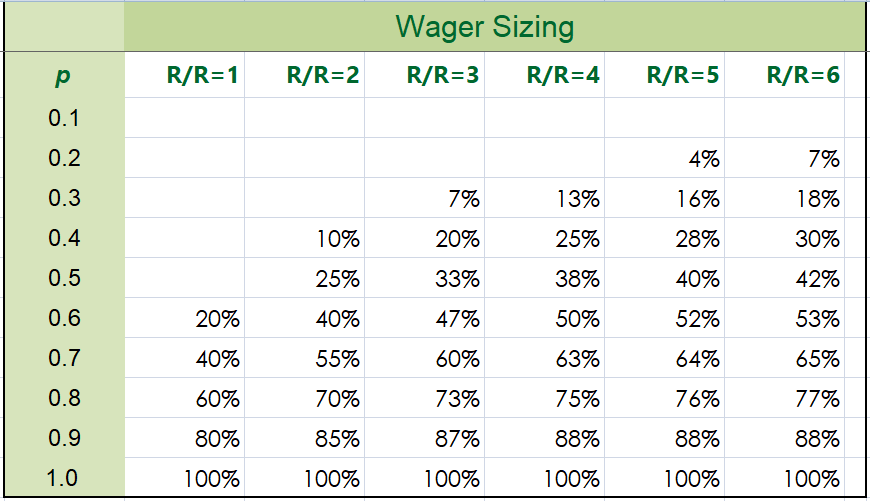

Then enter your win rate if you dont know what your win rate is you can look at your trade history and calculate it first or just backtest and take notes to find. Let you calculate your risk reward ratio with a simple way. Web If you buy 100 shares of a stock at 100 for a 10000 position size and your stop loss is at 97 and your profit target is at 109 here are your risk reward dynamics.

2 2 8 020 or 20. Breakeven Win rate Risk Rate Risk Rate Reward Rate So if we have riskreward ratio of 28. Web What Is a 3 to 1 riskreward ratio.

For example if youre. Web Typically risk-to-reward is expressed as a ratio that compares the relative amount of reward to the amount of risk. The riskreward ratio is calculated by the following formula.

Web Get started its free Play Video Analyze Quantify the volatility of future returns Profit Table Generate return data Run a backtest of your chosen trading signals. Reward 25-2020 100 25. A 3 to 1 risk-reward ratio measures the potential profit for every dollar of risk in a trade.

Web Risk Reward Calculator.

1

:max_bytes(150000):strip_icc()/GettyImages-160519027-9bc7b5b9500346eda384937f12423c93.jpg)

Investopedia

1

Altrady

Getknowtrading

Corporate Finance Institute

Forex Central Net

Educba

The Market Structure Trader

Babypips Com

Altrady

:max_bytes(150000):strip_icc()/dotdash_Final_Measure_Profit_Potential_With_Options_Risk_Graphs_Mar_2020-01-91faf67825434baba1a46837f4bf1ef3.jpg)

Investopedia

Risk Calculator App

Earnforex

Seeking Alpha

Kagels Trading

The Market Structure Trader